Thoughts on life, technology, education and entrepreneurship

Antiquated Banking Practices

December 23, 2021

Hiring Stories

September 06, 2021

Looking back, looking forward!

August 30, 2021

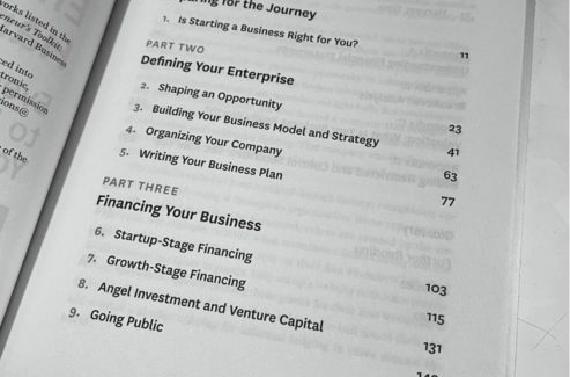

Banish Business Books

August 03, 2021

Information Overload

July 28, 2021

42! Do I have all the answers?

August 29, 2020

Be lucky; always!

July 06, 2020

Git quick reference

July 05, 2020

The streamlined Volcker 2.0 can open new doors for banks

January 22, 2020

Banking on RPA

January 20, 2020